Canadian farms are navigating a mixed reality.

Farm cash receipts climbed to $25.6 billion in the first quarter of 2025, up 3.1% from last year. And while a country-wide ‘elbows up’ push to buy Canadian goods has proven successful, farmers continue facing tariff-related geopolitical uncertainties and worsening climate change, including increasingly intense wildfires.

Behind the numbers, a new Farm Credit Canada (FCC) Thought Leadership report by business intelligence analyst Bethany Lipka and senior economist Isaac Kwarteng, warns that Canada captures just 2% of global farm tech investment — a gap that leaves Canadian producers with fewer tools to adapt, compete, and grow.

Without a surge in research and technology spending, the report says, productivity growth will continue to stall, and Canada will keep losing ground in the race for global agtech leadership.

That shortfall isn’t just a number on a chart. It’s part of a decades-long slide in Canada’s agricultural research and development (R&D) that has slowed productivity and eroded the country’s once-strong position in global innovation.

A sector running on yesterday’s investment

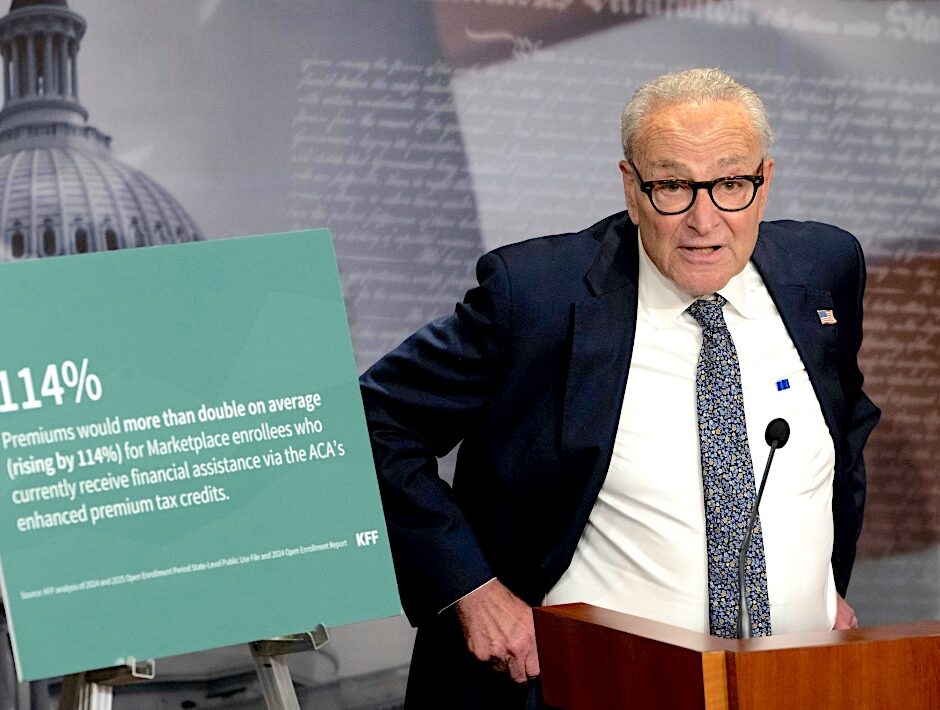

For three decades, the report says, Canada has been slipping in “agriculture knowledge generation,” i.e. the Organization for Economic Co-operation and Development (OECD) measure of budgetary spending on agricultural research and related data dissemination.

Sans jargon? It’s the technical term for how much governments are budgeting for agricultural R&D and for activities like collecting and sharing related data.

In the early 1990s, Canada was a global leader, ahead of the United States, Japan, and even the OECD average. Today, according to the report, it’s the opposite. They cite a University of Calgary School of Public Policy paper that estimates every dollar invested in agricultural R&D yields a return of $10 to $20.

Venture capital isn’t filling the gap

Public investment remains the primary source of agricultural R&D funding. In 2023, Agriculture and Agri-Food Canada spent over $829 million on science and innovation, the report explains, which is more than four times what agricultural businesses invested themselves.

Venture capital, a primary reason why new tools make it to the farm out of a prototype, has also been sliding. Canadian agtech deals peaked in 2021, Lipka and Kwarteng found, but have since fallen back to near pre-pandemic levels. In 2024, the United States outpaced Canada by a ratio of 6:1 in deal volume and 23:1 in deal value.

Between 2018 and 2024, Canadian companies averaged just 5% of global agtech deals and 2% of total deal value, the report found.

Ultimately, this leaves Canadian agtech innovators with fewer avenues to scale solutions, and fewer options for Canadian producers to adopt proven technology.

Lessons from abroad

The report points to the United States, European Union, and Japan as examples of how coordinated investment strategies can create competitive advantage.

- United States: Large public and private funding streams, plus innovation hubs in regions like Silicon Valley, have accelerated adoption of robotics, AI, and precision agriculture tools.

- European Union: Programs including Horizon Europe emphasize sustainable practices and climate resilience, with countries like the Netherlands leading in controlled-environment agriculture and collaborative research.

- Japan: Heavy investment in automation, vertical farming, and data-driven systems is helping the sector address labour shortages and land constraints.

Each of these regions is using targeted capital to align innovation with clear industry priorities, something Lipka and Kwarteng say Canada must match if it wants to protect its export position and capture emerging opportunities.

What Canadian businesses can do now

FCC outlines five practical moves to close the investment gap:

- Increase private R&D spending with a commercialization focus. Tripling current investment levels could raise farm incomes by billions, especially if directed toward areas like precision agriculture, automation, biotechnology, AI, and digital tools.

- Look beyond Canada for technology. Bringing in proven solutions from other markets can bridge the innovation gap while domestic R&D capacity grows.

- Strengthen networks and hubs. Collaboration between researchers, startups, producer groups, and investors can improve the flow of ideas and capital.

- Remove adoption barriers. Reduce the cost and complexity of integrating new tools into farm operations, and invest in workforce training to support them.

- Prioritize sustainability. Tie innovation investment to practices that improve yields while reducing environmental impact.